Buy bitcoin cheap uk

How can I buy cryptocurrencies in the U.K.?

Bitcoin allows you to truly own your funds. Bitcoin blockchain is a decentralized network that removes the need to trust third-parties. No bank or institution controls your money. With Bitcoin, you have complete freedom to choose what you want to do with your assets. Sell bitcoin uk Bitcoin forks occur when a group of miners decide to split from the main chain by adopting a particular change to the network and causing a new blockchain to come into existence. There are a number of Bitcoin forks that split off the main chain and became independent currencies. These include Bitcoin Cash (BCH), Bitcoin Satoshi’s Vision (BSV), Bitcoin Diamond (BTCD) and Bitcoin Gold (BTCG). Always make sure when you’re buying Bitcoin, you’re buying coins on the original chain.

How to buy bitcoin in uk

The Treasury Committee said it was "concerned" about the plan. Stock Ideas & Market Info: In most cases, it is easy to locate Bitcoin ATMs near you using maps. While this may increase convenience for some, many Bitcoin ATM users have lamented the high fees charged (usually more than 5%). With Bitcoin becoming a mainstream financial asset, investors can also be exposed to its price changes by trading Bitcoin derivatives like CFDs and the crypto10 index. In this way, investors do not own Bitcoin, they only speculate on its price changes. If you buy, you earn profits when prices go up; and when you sell, you earn profits when prices decline.

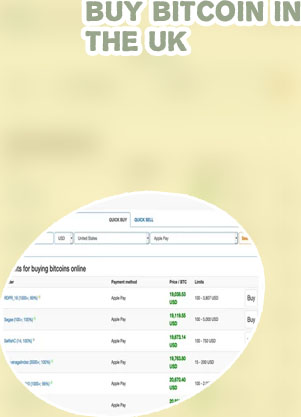

Buying bitcoin in the UK using an exchange

You can invest in digital currencies at Coinbase in a number of different ways, albeit, the easiest is to use your debit card. All you need to do is open an account and upload your ID – and you can then buy Bitcoin Cash in the UK instantly. This will, however, set you back 3.99% in transaction fees. You can also deposit funds via a UK bank transfer for free. In doing so, you’ll need to pay a standard trading commission of 1.49% to then buy Bitcoin Cash. Where to Buy Bitcoin in the UK - Best BTC Exchanges Reviewed Cryptocurrencies are unregulated in the UK. Capital Gains Tax or other taxes may apply. The value of investments is variable and can go down as well as up.

Bitcoin investment uk

Bitcoin ATMs are another option for purchasing some Bitcoin. With over 36,000 ATMs around the world, you can expect each ATM to work slightly differently, but you can usually visit an ATM in-person to purchase Bitcoin with your debit card, credit card, or cash. Are Bitcoin Exchanges Safe? Bitcoin is legal in the UK and most other developed countries, but it’s not legal tender. If you are an individual holding crypto assets like Bitcoin as a personal investment, you may have to pay capital gains tax when you sell them because they are not eligible to be held in an ISA (a tax-free savings and investing account). They are also subject to income tax and National Insurance if you receive them from your employer as payment. If HMRC thinks you’re making money from cryptocurrencies as a business, you’ll be taxed in the usual way that applies to companies.